AMF

Overview

AMF Assurance provides insurance solutions tailored to public accountants in France. With the introduction of the Liability of Public Managers (LPM) regime, the legal framework shifted, reducing individual liability and making existing insurance policies obsolete. This required a complete redesign of AMF’s digital experience to align with new regulations and user expectations.

-

Creating high fidelity mock-ups & prototypes

Conducting user research

-

Figma

Figjam

Power Point

-

UX Designer

UI Designer

Challenges

Regulatory shift

Public accountants and authorizing officers could previously insure themselves against financial errors, but under the new law, their individual liability was reduced, requiring an entirely new insurance offering.

Complexity in user needs

The new law introduced uncertainty. Users needed clear, reassuring communication about the changes and how they affected their insurance needs.

Engagement & conversion issues

The previous subscription process was long and complex, causing drop-offs before users could see their personalized insurance offer.

Project Goals & Solutions

Redefining the insurance offer based on user insights🎯 Goal

Ensure the new insurance offer meets the evolving needs of public accountants.

💡 Solution

Conducted extensive user research (25 participants) to understand expectations, pain points, and behaviors.

Developed personas to guide product decisions.

Aligned the sales pitch & value proposition with user concerns to increase clarity and trust.

Designing a seamless, user-friendly subscription experience🎯 Goal

Optimize the insurance subscription flow to minimize friction and improve engagement.

💡 Solution

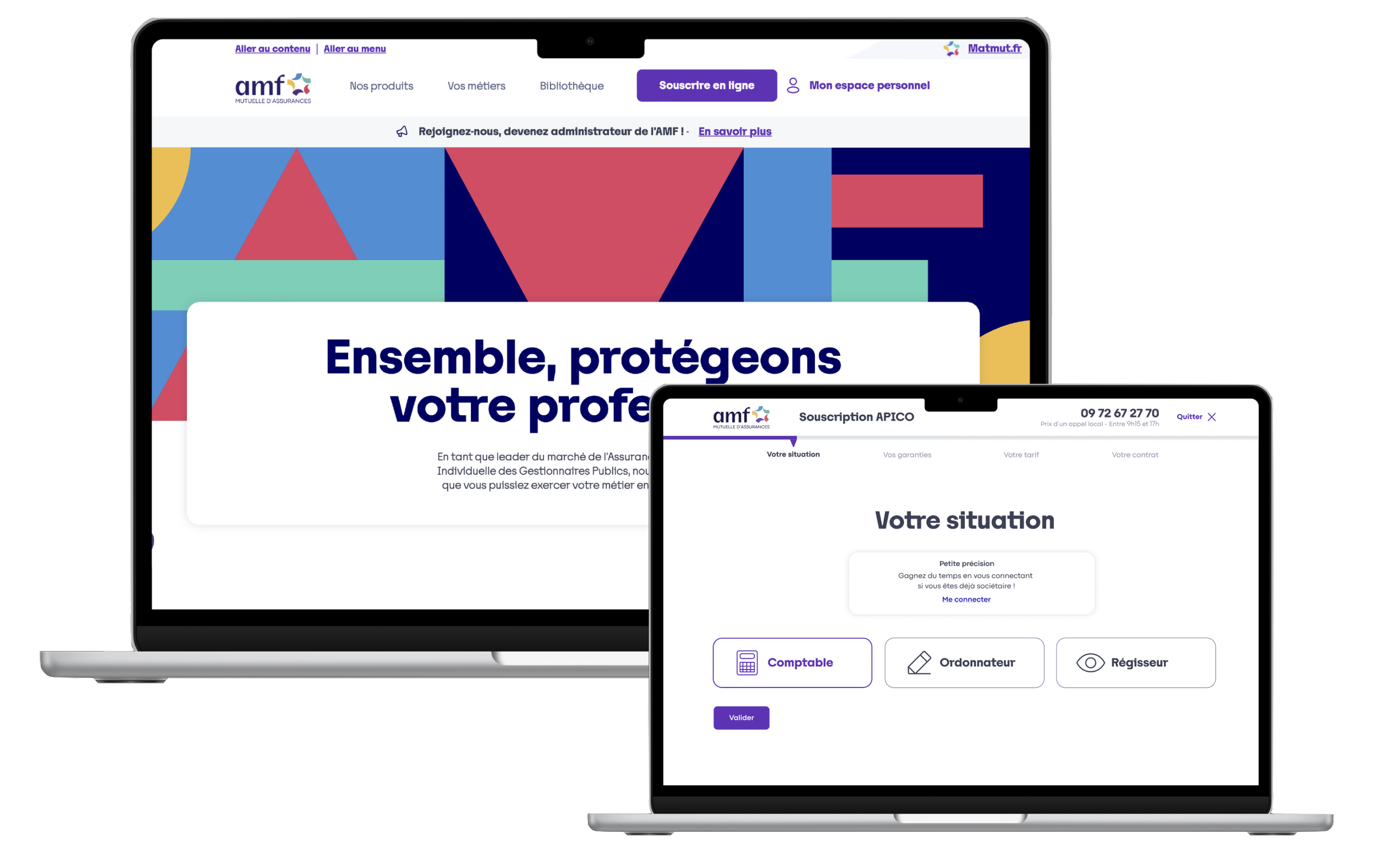

Created high-fidelity mockups & prototypes for a new, streamlined experience.

Reduced steps before price simulation, ensuring users received essential information without overwhelming them.

Focused on progressive data collection (e.g., collecting email upfront) to maintain engagement.

Ensuring the design was validated & implemented effectively🎯 Goal

Test our assumptions and refine the experience before development.

💡 Solution

Conducted user testing sessions to validate usability and clarity.

Iterated based on user feedback, refining content, layout, and interactions.

Smooth developer handoff, ensuring the final implementation matched the design vision.

Process & Design Approach

🔍 Research & Strategy A dedicated research team conducted extensive user interviews, shaping personas and defining the new insurance offer.

The team collaborated with business & legal teams to ensure compliance and clarity.

I was personnaly not involved in this phase. Our team used these insights to shape the digital experience during the following steps.

🎨 UX & UI DesignDeveloped wireframes, high-fidelity mockups, and interactive prototypes to visualize the new journey.

Focused on clear messaging & a streamlined subscription flow to improve engagement.

🧪 Testing & IterationRan user testing sessions to validate our assumptions and improve the journey.

Adjusted the content, structure, and interactions based on feedback.

👨💻 Developer Handoff & ImplementationWorked closely with developers, providing detailed specs & support to ensure smooth implementation.

Challenges Along the Way & How We Solved Them

Complex Regulatory ChangesCommunicating complex regulatory changes to users

💡 Solution

Used clear, concise messaging and progressive disclosure to break down legal concepts without overwhelming users.

Subscription drop offReducing drop-off in the subscription flow

💡 Solution

Designed a simplified, step-by-step process that prioritized essential information while keeping users engaged.

Team alignmentEnsuring alignment across teams

💡 Solution

Regular workshops & stakeholder reviews ensured that design decisions met business, legal, and user needs.